Africa’s Fintech Revolution: The $47 Billion Transformation

From SIM Cards to Skyscrapers: The Unstoppable Rise of African Fintech

Imagine a continent where the bank in your pocket has financially included over a billion people. This isn’t science fiction—it’s the reality of Sub-Saharan Africa (SSA), the global epicenter of financial technology innovation.

Africa’s financial landscape has moved far beyond its pioneering Mobile Money (MM) systems. While Mobile Money laid the essential groundwork, handling an astonishing $2.5 billion in transactions every single day, the market is now experiencing a seismic “fintech eruption.”

The numbers tell a powerful story of acceleration:

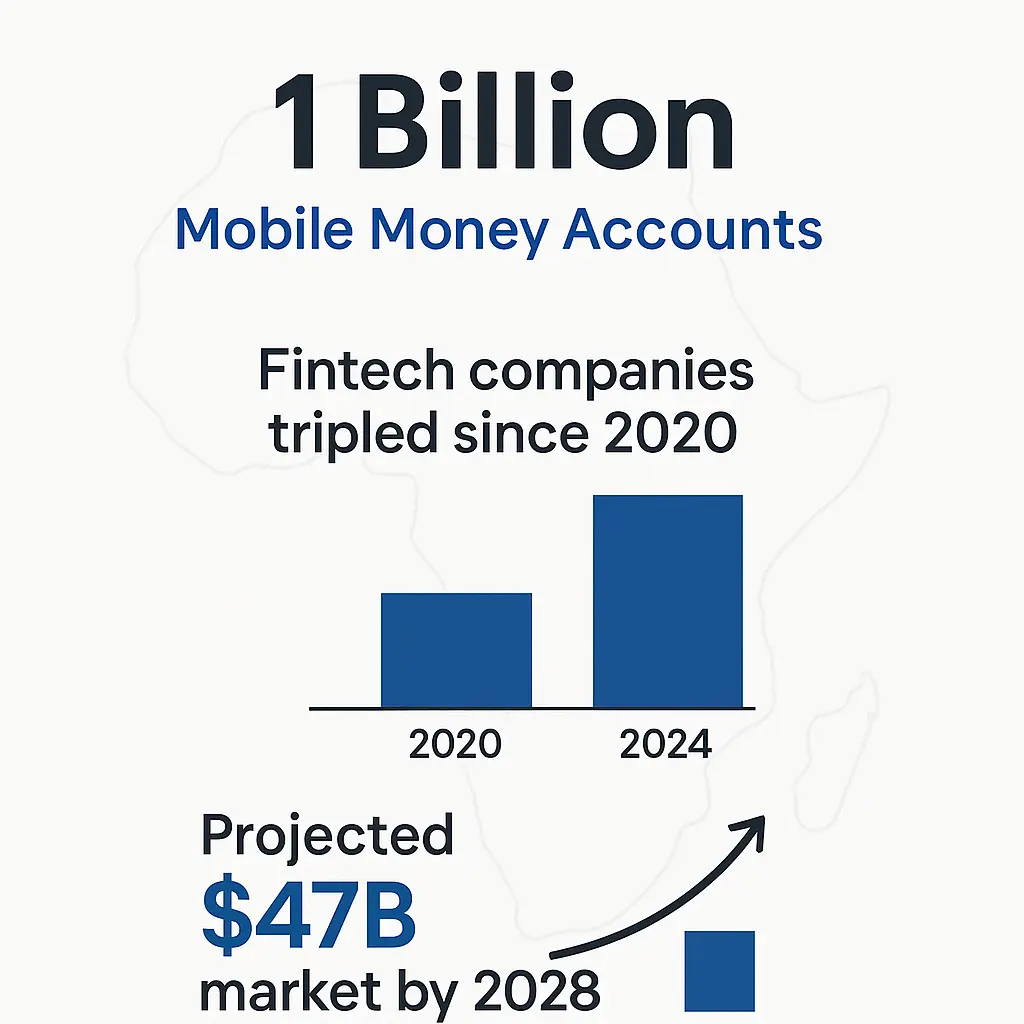

- 1 Billion Accounts: SSA now accounts for over one billion registered mobile money accounts, a testament to its successful technological leapfrog.

- The Eruption: The number of fintech companies across the continent has nearly tripled since 2020, with solutions expanding far beyond simple payments into credit, insurance, and asset management.

- The Big Goal: The African fintech market is projected to grow fivefold, reaching an expected revenue of $47 billion by 2028.

So, how is this revolution happening, and what are the two major hurdles that must be cleared to reach that $47 billion target?

Part 1: The Foundation: Mobile Money and the Digital Usage Gap

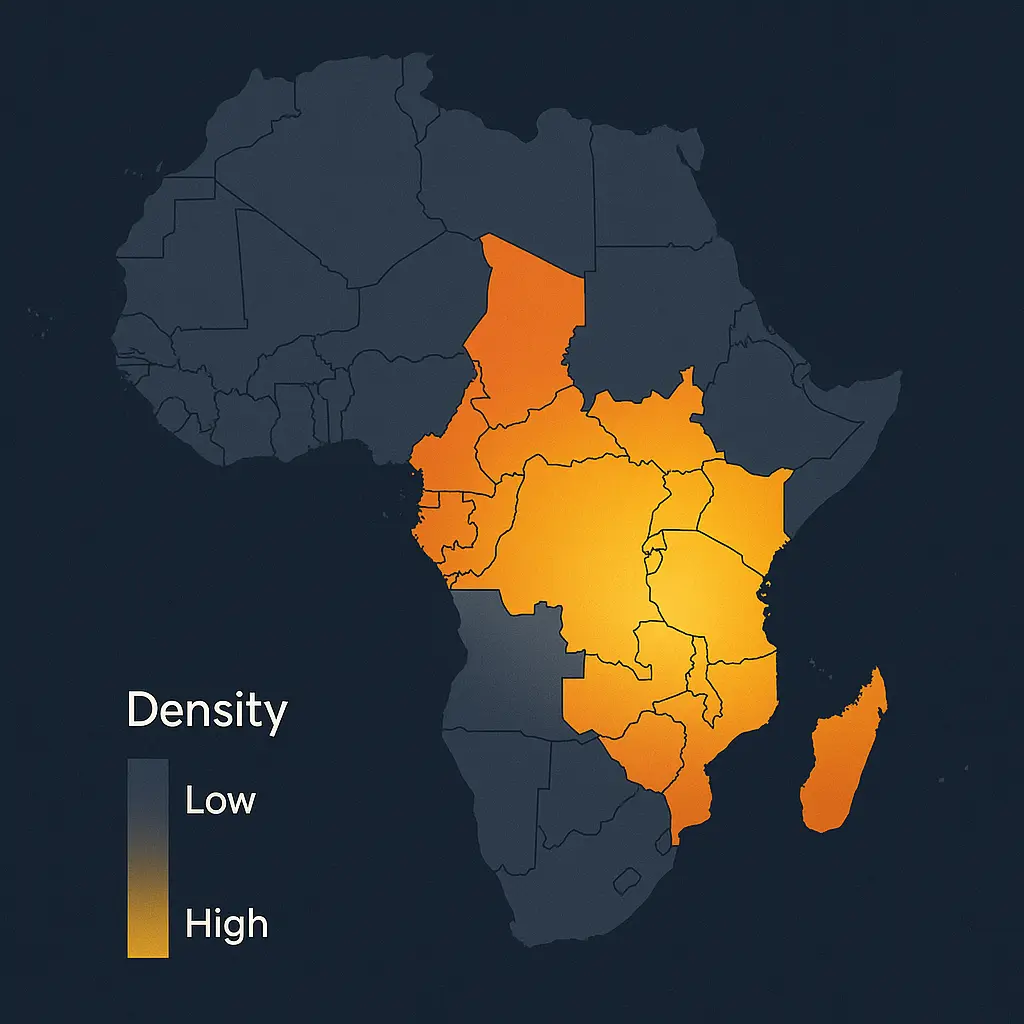

The sheer scale of Mobile Money adoption in East Africa—the pioneering region—is incredible. It accounts for over half of SSA’s transaction value and volume. MM platforms have created a foundation of trust and liquidity, allowing millions to transact without ever visiting a bank branch.

However, deep market analysis reveals a significant challenge hiding behind these impressive figures: the digital usage gap. Studies show that roughly 30% of mobile money account holders across SSA still require assistance from agents to perform their transactions. While this reliance initially helped the unbanked access the system, it introduces friction and higher hidden costs for low-income users.

To move from basic access to genuine financial autonomy, policy and education must now prioritize building digital competency alongside infrastructure.

Part 2: The Great Leap: Digital Wallets, VC, and the “Big Four”

The current wave of innovation is defined by sophisticated, app-based digital wallets. This trend is especially pronounced in West Africa, where higher smartphone penetration is driving adoption among younger, urban populations who demand slicker interfaces and advanced functionality.

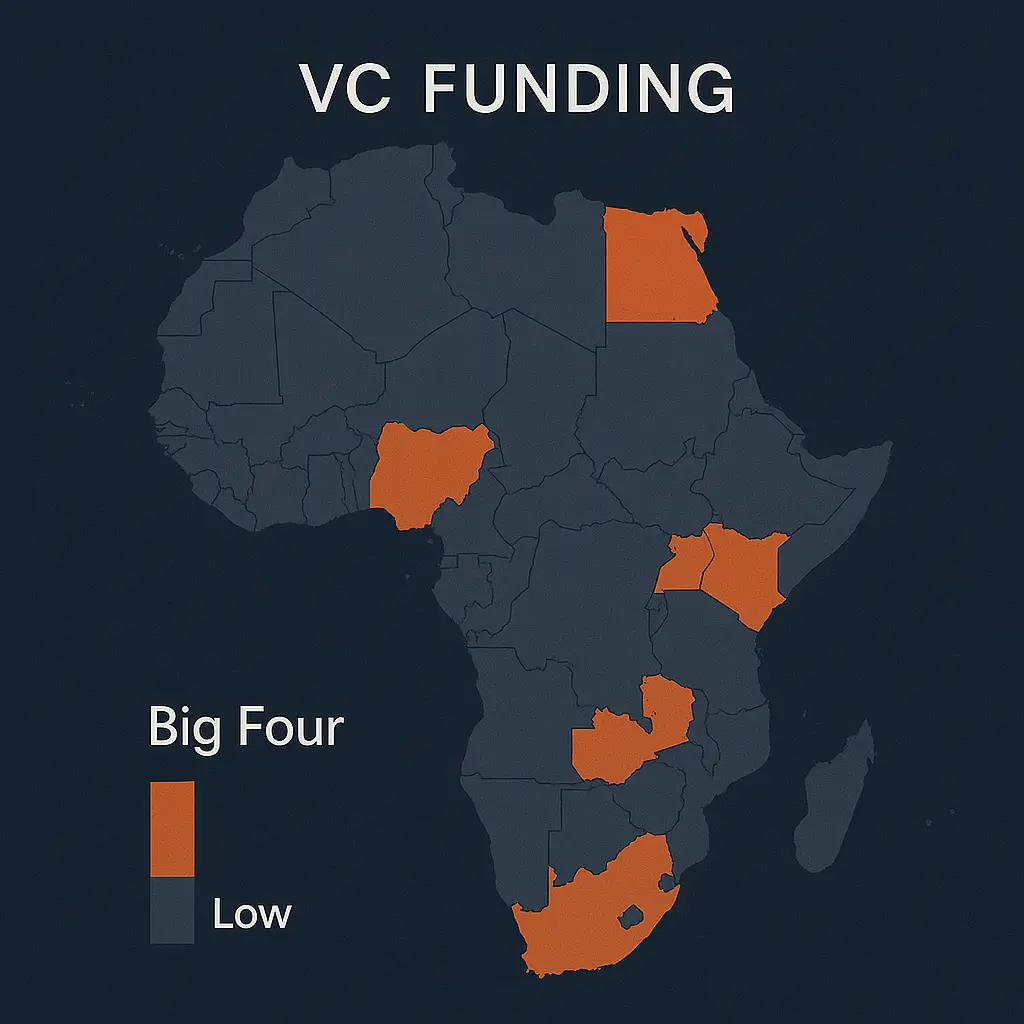

Venture Capital (VC) investors are paying attention. Despite a global slowdown, funding for African fintech demonstrated resilience, rebounding strongly in the second half of 2024. However, this capital is highly concentrated: 76% of total fintech funding is captured by the “Big Four” hubs: Nigeria, South Africa, Egypt, and Kenya.

This concentration signals a shift. Investors are moving away from low-margin, agent-dependent P2P models toward complex, high-growth services—like digital credit assessment using alternative data—that rely on strong infrastructure and app technology.

Part 3: The $5 Billion Drag: Africa’s Greatest Barrier to Scale

The single biggest threat to realizing the continent’s fintech potential is regulatory fragmentation.

The economic cost of navigating dozens of different national regulations and currency settlements is staggering. This cross-border friction results in an estimated $5 billion annual economic loss across the continent. This is the direct economic drag imposed by regulatory inertia, and it hinders intra-African trade, which is nearly double the industrial share of exports traded among African countries compared to other global destinations.

The solution is structural: the African Union (AU), in partnership with organizations like AfricaNenda, is developing a Payment Service Directive (PSD) aimed at harmonizing payment regulation. The success of this directive is crucial to dissolving trade barriers and making pan-African commerce truly seamless.

Part 4: Case Study: 1app.online and the Future of Global African Commerce

As the market matures, innovators are tackling the high-value challenges that traditional systems fail to address.

Companies like 1app.online are a prime example of this specialization. Positioned as a “cross border payment platform for Africa,” 1app focuses on providing African users, particularly in the vital Nigerian market, with the tools for global commerce and financial resilience.

Instead of acting as a traditional bank, 1app functions as an agile fintech facilitator, offering critical services by partnering with licensed institutions:

- Global Currency Access: Provides users with USD, EUR, and NGN accounts, along with virtual USD and NGN cards for international payments (e.g., subscriptions, tuition).

- Stablecoin Utility: Critically, the platform allows users to seamlessly receive, send, and swap stablecoins (USDC) to FIAT. In markets dealing with local currency volatility and strict foreign exchange controls, stablecoins offer a non-volatile, digital-native tool for preserving value and facilitating high-volume global transfers.

- B2B Integration: By offering Super APIs, 1app aims to embed its efficient payment infrastructure directly into other businesses, solving core payment pain points for the broader digital economy.

This model demonstrates the future: agile, technologically advanced platforms that provide immediate resilience against macroeconomic instabilities, enabling Africans to participate in global commerce effortlessly.

The Next Chapter

Africa’s fintech journey is a story of leapfrogging—moving from low-tech inclusion to high-tech sophistication. The mobile money foundation is secure, the digital wallet ecosystem is booming, and the capital is flowing into high-growth centers.

To truly unlock the projected $47 billion revenue, stakeholders must collectively focus on two strategic imperatives:

- Eliminating the $5 Billion Drag: Push aggressively for regulatory harmonization via the AU’s Payment Service Directive.

- Closing the Usage Gap: Invest in digital literacy programs that convert account access into genuine financial autonomy for every user.

The financial future of Africa is not just about payments; it’s about establishing the modern digital rails for continental and global trade. Companies like 1app.online are proving that the next phase of innovation will be defined by resilience, specialization, and seamless cross-border capability.

Reference: 1app.online – Global banking for Nigerians and cross border payment platform for Africa.